Letter requesting UniSuper divest from gas investments by Alec Roberts5 September 2020

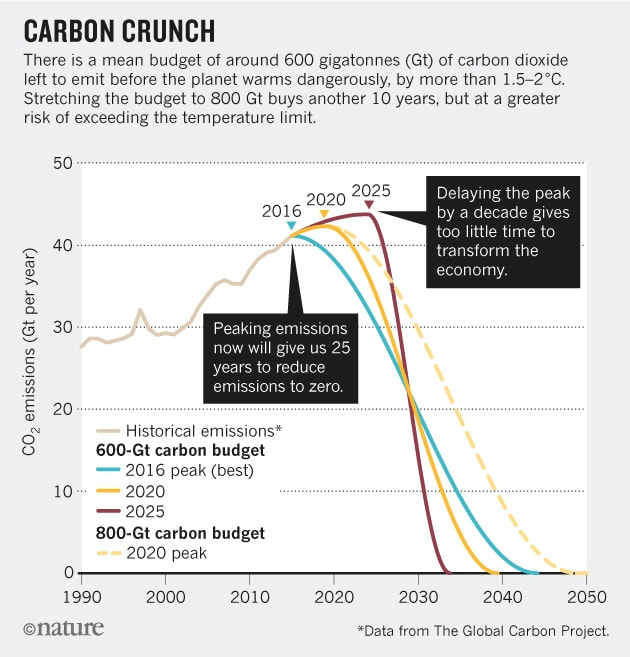

UniSuper Level 1, 385 Bourke Street Melbourne VIC 3000 E: [email protected] Dear UniSuper, I am writing to challenge the fund’s stated view that “gas will be an important transition fuel to a low carbon world”. I ask that you reconsider this position and divest from all companies seeking to expand gas production. I am a member of UniSuper and have my investment options in Sustainable High Growth and Global Environment Opportunities so not to be investing in Fossil Fuels. However, this is not enough. UniSuper need to divest fully from Fossil Fuels including gas and oil. The divestment of several thermal coal mining companies was a great first step in aligning UniSuper’s portfolio with my principles. I ask that you apply the same reasoning to gas producers, recognising the decline in gas production required to limit global warming to 1.5°C, and divest from all companies whose future prospects rely on expanding the sector. Natural gas as a “transition fuel”? Natural gas has often been touted as the “transition fuel” for the electricity sector to replace coal’s greenhouse gas emissions and eventually paving the way for an emissions free future for Australia. In response to an open letter on April 8 calling for UniSuper to immediately divest from companies that are actively undermining climate action, UniSuper Chairman Ian Martin stated that "Our base case is that gas will be an important transition fuel to a low carbon world."[1] This supported UniSuper’s “Climate risks and our investments” document which noted Natural Gas as being often cited as a transition fuel and that “In order for natural gas to fulfil its role as a transition fuel, infrastructure will need to be built.”[2] The concept of gas as a transition fuel is out of date and I believe incorrect. It is simply too expensive and too emissions intensive to be so. Methane leaks from natural gas production can make the process nearly as carbon intensive as coal. The use of gas in electricity production has reduced in recent years and modelling of the future electricity grid and further evidence has indicated that it is unlikely that gas will play a major role in the transition from coal-fired power plants to renewable energy and storage. The electricity market has already moved away from gas in Eastern Australia, with a 59% decline in usage in the National Electricity Market since 2014, whilst renewable energy has increased by 25% during the same period.[3] Furthermore, flexible gas plants already in the grid are running well below capacity.[4] AEMO forecast that increasing renewable generation developments in the NEM are expected to continue to drive down system normal demand for gas-powered generation (GPG). [5] The AEMO modelled the future electricity grid in its Integrated Systems Plan.[6] [7] The results showed for all scenarios that the transition from coal to renewable energy would not be via gas.10 The role of gas would be reduced with a decline in gas generation through to 2040.9 The report notes that to firm up the inherently variable distributed and large-scale renewable generation, there will be needed new flexible, dispatchable resources such as: utility-scale pumped hydro and large-scale battery energy storage systems, distributed batteries participating as virtual power plants, and demand side management.12 13 It also noted that new, flexible gas generators such as gas peaking plants could play a greater role if gas prices materially reduced, with gas prices remaining low at $4 to $6 per GJ.13 However this is unlikely as gas prices have tripled over the past decade and expected NSW gas prices (for example) are over 60% more than this price.10 [8] AEMO noted that the investment case for new GPG will critically depend on future gas prices, as GPG and batteries can both serve the daily peaking role that will be needed as variable renewable energy replaces coal-fired generation. In their 2020 Gas Statement of Opportunities report, AEMO predicted that as more coal-fired generation retired in the long term, gas consumption for GPG in the National Electricity Market was forecast to grow again in the early 2030s, recovering to levels similar to those forecast for 2020.11 However, in a later report, AEMO determined that by the 2030s, when significant investment in new dispatchable capacity is needed, new batteries will be more cost-effective than GPG. 13 Furthermore, the commissioning of the Snowy 2.0 pumped hydro project in 2026 will result in less reliance on GPG as a source of firm supply.11 AEMO noted that stronger interconnection between regions reduces the reliance on GPG, as alternative resources can be shared more effectively. 13 The expansion of network interconnections enables the growth of variable renewable energy without a significant reliance on local gas generation.[9] Supporting this assertion, the AEMO announced a series of actionable transmission projects including interconnector upgrades and expansions and network augmentations supporting recently announced renewable energy zones.[10] 13 AEMO noted that as each of these new transmission projects is commissioned, the ability for national electricity market regions to share resources (particularly geographically diverse variable renewable energy) is increased, and therefore demand for GPG is forecast to decrease.11 The Marinus Link is forecast to be commissioned in 2036, with surplus renewable generation from Tasmania then being available to the mainland National Electricity Market, which would see further declines in gas-fired generation, despite continuing coal-fired generation retirements.11 AEMO recently noted that GPG can provide the synchronous generation needed to balance variable renewable supply, and so is a potential complement to storage, with the ultimate mix depending upon the relative cost and availability of different storage technologies compared to future gas prices. 5 However, the current installation of synchronous condensers in South Australia and in the eastern states to increase system strength and stabilise the electricity network will reduce the need for gas-fired generators acting in the role of synchronous generators as more renewables enter the grid.[11] Ancillary services are likely to utilise battery storage and synchronous condensers in the future and no longer require the use of GPG. Need for additional gas? Gas demand has been declining in recent years and predictions are that gas demand will not increase in the future and may decrease, therefore it is unlikely that additional gas will be required in the Eastern Australian domestic gas market to meet residential, commercial, and industrial gas demand. From 2014 to 2018, annual consumption of natural gas in NSW fell by 15 per cent, with the major contributor of this fall in consumption being the reduction in the use of gas for power generation.[12] Whereas domestic demand for gas has fallen for use in manufacturing by 14%, it has dropped by a staggering 59% for power generation by since 2014. 9 ACCC recently stated that “overall consumption of gas in the east coast was largely unchanged over the first five months of 2020 relative to 2019”[13] and that the COVID-19 pandemic has not had a material effect on the overall level of production or consumption in the East Coast Gas Market. However, they stated that it is unknown whether the contraction in economic activity brought about by the COVID-19 pandemic will result in a decline in domestic and/or international demand for gas in 2021. Commercial and Industrial gas user (C&I) consumption is predicted to be flat or fall. C&I’s utilise gas for applications such as a heat source for boilers and furnaces, for producing steam, or for drying processes, and as a feedstock to produce fertilisers, explosives, chemicals, and plastics. ACCC reported that a number of suppliers expected GPG and C&I demand to be lower in 2020 and that many C&I users reported that they are slowing production due to the COVID-19 pandemic which raised the potential for significant adverse consequences for these users in having to pay for gas that they cannot use or on-sell (with take or pay contract obligations). ACCC concluded that there is now a considerable degree of uncertainty surrounding the demand for gas by gas users (non GPG) following the COVID-19 pandemic and the impact this has had on economic activity, both domestically and internationally.19 Whereas 2019 was somewhat of an anomalous year with failures in Coal Powered Generation resulting in additional GPG being utilised, the ACCC reported that GPG demand over the first five months of 2020 was 36% lower than over the same period in 2019. Furthermore, AEMO forecast that, demand for GPG is predicted to continue to fall by over 85% from 2019 levels by 2028.[14] As an investment, gas is on shaky grounds. Since 2014, Santo’s write-downs are approaching $8bn. Internationally things are not better for gas. In the U.S., the number of operating drill rigs has fallen 73% in the last 12 months. And US LNG exports have more than halved so far in 2020. Deloitte estimates that almost a third of U.S. shale producers are technically insolvent at current oil prices.[15] Moving away from gas The ACT is planning to go gas free by 2025. This is expected to reduce their overall emissions by 22%. As part of the ACT Climate Change Strategy 2019-2025, all government and public-school buildings will be completely powered by 100% renewable energy eliminating the need for natural gas. The ACT has also removed the mandatory requirement for new homes built in the ACT to be connected to the mains gas network and will begin to introduce new policies to replace gas appliances with electric alternatives. Some 14% of residents have already converted over to 100% electric. [16] There are moves in other jurisdictions to remove the mandatory requirement for a gas connection in new developments such as in South Australia. AEMO forecasts further reductions in gas use as consumers fuel-switch away from gas appliances towards electrical devices, in particular for space conditioning. The Commonwealth and NSW Government are exploring options to free-up gas demand through electrification, fuel switching and energy efficiency. [17] Fuel switching from gas appliances towards electrical devices can often be more economic. A 2018 study of household fuel choice found that 98% of households with new solar financially favoured replacement of gas appliances with electric. With existing/no solar 60-65% of households still favoured replacement of gas appliances with electric. [18] In the residential sector, for example, reverse-cycle air-conditioning is expected to reduce gas demand that could have arisen due to gas heating.[19] Therefore, it is unlikely that additional gas will be required in the Australian domestic gas market to meet residential, commercial, and industrial gas demand. The role of natural gas in a low-carbon economy To address the issue of dangerous climate change, Australia, along 196 other parties, is a signatory to the Paris Agreement, which entered into force on 4 November 2016. The Paris Agreement aims to strengthen the global response to the threat of climate change, by: Holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels, recognizing that this would significantly reduce the risks and impacts of climate change.[20] The IPCC report provides an estimate for a global remaining carbon budget of 580 GtCO2 (excluding permafrost feedbacks) based on a 50% probability of limiting warming to 1.5 degrees relative to 1850 to 1900 during and beyond this century and a remaining carbon budget of 420 GtCO2 for a 67% chance (See Figure 1 for details). [21] Figure 1 Remaining Carbon Budget[22] - see above Committed emissions from existing and proposed energy infrastructure represent more than the entire carbon budget that remains if mean warming is to be limited to 1.5 °C and perhaps two-thirds of the remaining carbon budget if mean warming is to be limited to less than 2 °C. Estimates suggest that little or no new CO2-emitting infrastructure can be commissioned, and that existing infrastructure may need to be retired early (or be retrofitted with carbon capture and storage technology) in order to meet the Paris Agreement climate goals.[23] Australia’s remaining emission budget from Jan 2017 until 2050 for a 50% chance of warming to stay below 1.5C warming relative to pre-industrial levels was estimated to be 5.5 GTCO2e.29 Adding the GHG emissions expended in 2017[24], 2018[25], and 2019[26], this leaves just 3.8 Gt CO2e remaining as at December 2019. This leaves 6-7 years left at present emission rates of the 2013-2050 emission budget to stay below 1.5°C. Therefore, at current emissions rates, Australia will have exceeded its carbon budget for 2050 by 2026. It therefore follows that no new fossil fuel development in Australia that is not carbon neutral can be permitted because its approval would be inconsistent with the remaining carbon budget and the Paris Agreement climate target. It follows that gas infrastructure development would contribute to an unacceptable increase in greenhouse gas emissions. This includes Santo’s Narrabri Gas Project, which is estimated to result in 94.2 million tonnes of greenhouse gases over the life of the project Greenhouse gas and climate change – Fugitive emission The CSIRO report “Fugitive Greenhouse Gas emissions from Coal Seam Gas Production in Australia” [27] noted that fugitive emissions for Natural Gas in Australia are estimated to be 1.5% of gas extracted. It should be noted that if fugitive emissions exceeded 3.1% then the emissions intensity would match that of coal (due to the fact that methane is 86 times more powerful as a greenhouse gas than CO2 over 20 years and 34 times more powerful over a 100-year time period).[28] They also noted that unconventional gas industry such as Coal Seam Gas would result in greater levels of fugitive emissions than the conventional gas industry. Therefore, the use of natural gas to displace coal-fired power generation would not necessarily reduce CO2 emissions. Alternative sources of gas Other alternative sources of gas exist that have significantly lower emissions than the natural gas and in the long term could replace the need for new natural gas infrastructure. It should be noted that these technologies Green Hydrogen, Biogas and Biomethane not only look to transition electricity generation away from natural gas but also for other uses such as combustion for heat. Hydrogen Hydrogen is a colourless, odourless, non-toxic gas that is an excellent carrier of energy and can be used for a broad range of energy applications including as a transport fuel, a substitute for natural gas and for electricity generation.[29] Hydrogen gas can be produced from water in a process known as electrolysis, and when powered by renewable energy, the hydrogen produced is free from carbon emissions, making it an attractive way to decarbonise transport, heating and electricity generation.40 AEMO stated that, “Hydrogen has the exciting potential to become an alternative energy storage technology and a new export commodity for Australia” which could be used to help decarbonise the domestic heat, transport and the industrial and commercial sectors in Australia and noted that development of the hydrogen industry would potentially impact both natural gas and electric demands.24 12 Several developments involving green / renewable hydrogen are either planned or underway in Australia. AEMO highlighted the potential for green steel production in Australia due to abundant renewable resources and the increased demand for low emissions industrial commodities worldwide. 24 ‘Green steel’ can be made via a direct reduction process which uses hydrogen (made from renewable energy) as the heat source and reducing agent to produce pig iron. The by-product of the iron reduction process using hydrogen is water, rather than carbon dioxide in conventional steel making. Renewable energy is then used by an electric arc furnace to produce low-emissions green steel. The Arrowsmith Hydrogen Project, which will be built at a facility in the town of Dongara, located 320km north of Perth, will utilise dedicated onsite renewable energy 85MW of solar power, supplemented by 75MW of wind generation capacity to generate 25 tonnes of green hydrogen a day and will be operational in 2022.[30] ATCO’s Clean Energy Innovation Hub, located in Jandakot in Western Australia, is being used to trial the production, storage and use of renewable hydrogen to power a commercial-scale microgrid, testing the use of hydrogen in different settings and applications including in household appliances.[31] This includes optimising hydrogen storage solutions, blending hydrogen with natural gas and using hydrogen as direct use fuel. Green hydrogen will be produced from on-site solar using electrolysis, fuelling a range of gas appliances and blending hydrogen into the natural gas pipeline. The $3.3 million development project will evaluate the potential for renewable hydrogen to be generated, stored, and used at a larger scale. ATCO aims to assess the practicalities of replacing natural gas with hydrogen at a city-wide scale across a municipality.[32] The new chair of the Australian Energy Regulator, Clare Savage recently stated: “The national gas industry could also undergo significant change as some jurisdictions move towards a zero carbon emissions policy. This could have significant consequences for the future of gas pipeline networks. In response, the AER recently supported the future recovery of Jemena’s investment in trialling the production of hydrogen from renewable energy for injection into its Sydney network. If hydrogen trials such as Jemena’s prove successful, the natural gas networks could be re-purposed to distribute hydrogen. If not, the economic life of the assets could be limited.” [33] Biogas and Biomethane Biogas is a renewable energy source, that is continuous and dispatchable, reliable, and local source of energy. Biogas can be converted into heat and/or electricity using boilers, generators or with Combined Heat and Power units.[34] Biogas also provides an alternative route for waste treatment and, as such, can help divert waste from landfill. Biogas consists primarily of methane and carbon dioxide, with trace amounts of other gases such as hydrogen sulphide, water vapour, oxygen, and ammonia.[35] Biogas can also be upgraded into biomethane: a renewable gas that can replace natural gas with a chemical composition very similar to natural gas. Biomethane is produced from the separation of methane from the other gases. 46 Biogas and its industry offer many benefits:

Australian business, industry and utilities recently signed an open letter to the Commonwealth Government advocating for biomethane to be injected into the gas distribution networks to enable the lowest cost transition to a decarbonised energy market and address a number of challenges including:

Both Renewable Hydrogen and Biogas/Biomethane can displace or replace natural gas as a fuel significantly reducing GHG emissions. These technologies show promise in Australia with the resources available locally. Once developed these would see future assets such as Santo’s proposed Narrabri Gas project left stranded. In summary, gas can no longer be considered a transition fuel to a low carbon economy. Surely any company seeking to expand the fossil fuel industry such as the Gas industry is taking unacceptable risks with our future as well as its own and is not ethically compatible with my retirement savings and those of my fellow members. I and my fellow members will continue to campaign until UniSuper has divested from all such companies. Thank you for taking the time to read my letter and I look forward to your response. Sincerely, Alec Roberts REFERENCES [1] UniSuper (2020, May 8). Letter in response to UniSuper Divest open letter 8 May 2020. Retrieved from https://unisuperdivest.org/wp-content/uploads/2020/05/Letter-in-response-to-UniSuper-Divest-open-letter-8-May-2020.pdf [2] UniSuper (2019, November) Climate risk and our investments. Retrieved from https://www.unisuper.com.au/~/media/files/forms%20and%20downloads/investment%20documents/climate-risk-and-our-investments.pdf?la=en [3] Robertson, B. (2020, July 23). IEEFA update: Australia sponsors a failing gas industry. Retrieved from https://ieefa.org/ieefa-update-australia-sponsors-a-failing-gas-industry/ [4] Morton, A. (2020, March 8). 'Expensive and underperforming': energy audit finds gas power running well below capacity. Retrieved from https://www.theguardian.com/environment/2020/mar/08/expensive-and-underperforming-energy-audit-finds-gas-power-running-well-below-capacity [5] AEMO (2020, March). Gas Statement of Opportunities, March 2020, For eastern and south-eastern Australia. Retrieved from https://aemo.com.au/en/energy-systems/gas/gas-forecasting-and-planning/gas-statement-of-opportunities-gsoo [6] AEMO (2019, December 12). Draft 2020 Integrated System Plan - For the National Electricity Market. Retrieved from https://aemo.com.au/-/media/files/electricity/nem/planning_and_forecasting/isp/2019/draft-2020-integrated-system-plan.pdf?la=en [7] AEMO (2020b, July 30). 2020 Integrated System Plan - For the National Electricity Market. Retrieved from https://aemo.com.au/-/media/files/major-publications/isp/2020/final-2020-integrated-system-plan.pdf?la=en [8] ACCC (2020, January) Gas inquiry 2017-2025 – Interim Report. Retrieved from https://www.accc.gov.au/system/files/Gas%20inquiry%20-%20January%202020%20interim%20report%20-%20revised.pdf [9] AEMO (2020c, July 30) 2020 ISP Appendix 2. Cost Benefit Analysis. Retrieved from https://aemo.com.au/-/media/files/major-publications/isp/2020/appendix--2.pdf?la=en [10] Energy Source & Distribution (2020, July 30). AEMO reveals Integrated System Plan 2020. Retrieved from https://esdnews.com.au/aemo-reveals-integrated-system-plan-2020/ [11] Parkinson, G. (2020, May 25) Big spinning machines arrive in South Australia to hasten demise of gas generation. Retrieved from https://reneweconomy.com.au/big-spinning-machines-arrive-in-south-australia-to-hasten-demise-of-gas-generation-64767/ [12] Pegasus Economics (2019, August) Report on the Narrabri Gas Project. Retrieved from https://8c4b987c-4d72-4044-ac79-99bcaca78791.filesusr.com/ugd/b097cb_c30b7e01a860476bbf6ef34101f4c34c.pdf [13] ACCC (2020, July) Gas inquiry 2017–2025 Interim report July 2020. Retrieved from https://www.accc.gov.au/system/files/Gas%20inquiry%20July%202020%20interim%20report.pdf [14] AEMO (2020, March 27) National Electricity & Gas Forecasting 2020 GSOO Publication. Retrieved from http://forecasting.aemo.com.au/Gas/AnnualConsumption/Total [15] Robertson, B. (2020, July 23). IEEFA update: Australia sponsors a failing gas industry. Retrieved from https://ieefa.org/ieefa-update-australia-sponsors-a-failing-gas-industry/ [16] Mazengarb, M. & Parkinson, G. (2019, September 16). ACT to phase out gas as it launches next stage to zero carbon strategy. Retrieved from https://reneweconomy.com.au/act-to-phase-out-gas-as-it-launches-next-stage-to-zero-carbon-strategy-92906/ [17] Energy NSW. (2020, January 31). Memorandum of understanding, Retrieved from https://energy.nsw.gov.au/government-and-regulation/electricity-strategy/memorandum-understanding [18] Alternative Technology Association (2018, July) Household fuel choice in the National Energy Market. Retrieved from https://renew.org.au/wp-content/uploads/2018/08/Household_fuel_choice_in_the_NEM_Revised_June_2018.pdf [19] AEMO (2020a, July 30). 2020 ISP Appendix 10. Sector Coupling. Retrieved from https://aemo.com.au/-/media/files/major-publications/isp/2020/appendix--10.pdf?la=en [20] IPCC (2018). Global Warming of 1.5°C: An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty, Intergovernmental Panel on Climate Change. Retrieved from https://www.ipcc.ch/sr15/ [21] Meinshausen, M. (2019, March 19). Deriving a global 2013-2050 emission budget to stay below 1.5°C based on the IPCC Special Report on 1.5°C. Retrieved from https://www.climatechange.vic.gov.au/__data/assets/pdf_file/0018/421704/Deriving-a-1.5C-emissions-budget-for-Victoria.pdf [22] Figueres, C., Schellnhuber, H. J., Whiteman, G., Rockström, J., Hobley, A., & Rahmstorf, S. (2017). Three years to safeguard our climate. Nature, 546(7660), 593–595. https://doi-org.ezproxy.newcastle.edu.au/10.1038/546593a [23] Tong, D., Zhang, Q., Zheng, Y., Caldeira, K., Shearer, C., Hong, C., Qin, Y., & Davis, S. J. (2019). Committed emissions from existing energy infrastructure jeopardize 1.5 °C climate target. Nature, 572(7769), 373-377. https://doi-org.ezproxy.newcastle.edu.au/10.1038/s41586-019-1364-3 [24] Climate Council (2018) Australia’s Rising Greenhouse Gas Emissions. Retrieved from https://www.climatecouncil.org.au/wp-content/uploads/2018/06/CC_MVSA0143-Briefing-Paper-Australias-Rising-Emissions_V8-FA_Low-Res_Single-Pages3.pdf [25] Cox, L. (2019, March 14). Australia's annual carbon emissions reach record high. Retrieved from https://www.theguardian.com/environment/2019/mar/14/australias-annual-carbon-emissions-reach-record-high [26] DISER (2020, May) National Greenhouse Gas Inventory: December 2019. Retrieved from https://www.industry.gov.au/data-and-publications/national-greenhouse-gas-inventory-december-2019 [27] CSIRO (2012). Fugitive Greenhouse Gas Emissions from Coal Seam Gas Production in Australia. Retrieved from https://publications.csiro.au/rpr/pub?pid=csiro:EP128173 [28] Robertson, B. (2020, January 30). IEEFA Australia: Gas is not a transition fuel, Prime Minister. Retrieved from https://ieefa.org/ieefa-australia-gas-is-not-a-transition-fuel-prime-minister/ [29] Tasmanian Government. (n.d.). Hydrogen. Retrieved from https://www.stategrowth.tas.gov.au/energy_and_resources/energy/hydrogen [30] Mazengarb, M. (2020, April 29). Massive hydrogen project gets green light after securing $300m investment. Retrieved from https://reneweconomy.com.au/massive-hydrogen-project-gets-green-light-after-securing-300m-investment-68959/ [31] Energy Source & Distribution (2018, October 4). Nel awarded contract for Australia’s first hydrogen microgrid. Retrieved from https://esdnews.com.au/nel-awarded-contract-for-australias-first-hydrogen-microgrid/ [32] ARENA (2018, July 3). Green hydrogen innovation hub to be built in WA. Retrieved from https://arena.gov.au/news/green-hydrogen-innovation-hub-to-be-built-in-wa/ [33] West, M. (2020, July 3). A Savage Call: energy tsar calls time on Australia’s gas cartel. Retrieved from https://www.michaelwest.com.au/a-savage-call-energy-tsar-calls-time-on-australias-gas-cartel/ [34] Ramos-Suárez, J. L., Ritter, A., Mata González, J., & Camacho Pérez, A. (2019). Biogas from animal manure: A sustainable energy opportunity in the Canary Islands. Renewable and Sustainable Energy Reviews, 104, 137–150. https://doi-org.ezproxy.newcastle.edu.au/10.1016/j.rser.2019.01.025t [35] Carlu, E. Truong, T. Kundevski, M. (2019, May). Biogas opportunities for Australia. ENEA Consulting – March 2019. Retrieved from: https://www.energynetworks.com.au/resources/reports/biogas-opportunities-for-australia-enea-consulting/ [36] Hughes, J. (2020, July 15). Business, industry and utilities back biogas for net zero Australia. Retrieved from https://www.worldbiogasassociation.org/business-industry-and-utilities-back-biogas-for-net-zero-australia/ [37] Bioenergy Australia (2020, June 9). Joint letter in support of Australian biomethane market development. Retrieved from https://www.bioenergyaustralia.org.au/news/joint-letter-in-support-of-australian-biomethane/

0 Comments

Leave a Reply. |

AuthorWrite something about yourself. No need to be fancy, just an overview. Archives

March 2024

Categories |

RSS Feed

RSS Feed