Submission - Australia's new Nature Postitive laws 28/03/2024

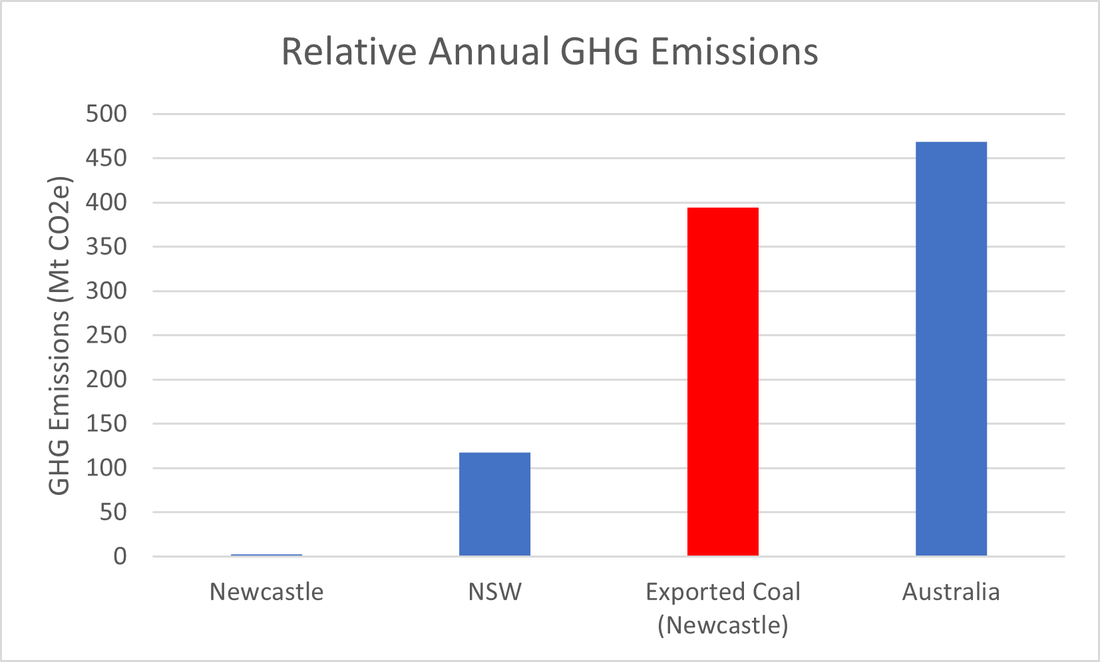

Department of Climate Change, Energy, the Environment and Water GPO Box 3090, Canberra ACT 2601, Australia Australia’s new Nature Positive laws To whom it may concern, Thank you for the opportunity to provide a submission into Australia’s new Nature Positive laws and taking the time to consider my submission. While acknowledging and supporting the Federal Government’s ambitious agenda to reform of our outdated, inefficient, and ineffective environment laws with the new Nature Positive laws, necessary improvements are needed, and further ambition is required to set Australia on a path of ecologically sustainable development to deliver “long-term economic growth, environmental improvement and the effective protection of Australia’s iconic places and heritage for the benefit of current and future generations”.[1] I live in the Lake Macquarie / Newcastle region in NSW. In 2023 I coordinated the development of a detailed Emission Reduction Plan for the City of Newcastle. In a volunteer capacity, I am a committee member of several organisations including the Hunter Community Alliance, Newcastle Climate Change Response, Hunter Innovation and Science Hub, and the Clean Energy Association of Newcastle and Surrounds. I am also a member of the Hunter Jobs Alliance and the Newcastle chapter of The Wilderness Society. I am involved in what could be termed environmental outreach, informing the public on environmental information, news, and activities through newsletters, conducting seminars, events, and conferences. I recently ran the Newcastle Climate Summit in November 2023. The EPBC Act is now over 24 years old and has failed to address the loss in biodiversity and extinction prevention of plants and animals or habitat destruction within Australia. The Act is complex and unwieldy and is in drastic need of reform. The Act needs to address the environmental threats and challenges that we face including cumulative impacts, climate change and habitat destruction through land clearing. The implementation of the Act is also constrained by significant resourcing issues. We need environmental laws that can effectively tackle the major environmental challenges Australia faces and to reverse the declining environmental trends in this country. I have provided feedback via submissions of the 2019-2020 Independent Review of the EPBC Act, and the Environment Protection and Biodiversity Conservation Amendment (Streamlining Environmental Approvals) Bill 2020 and appreciate the opportunity to provide feedback here. Matters of National Environmental Significance Matters of national environmental significance (MNES) (triggers) are an essential part of the Act that trigger assessment processes under the Act. These triggers should be retained and expanded to include vulnerable ecological communities (alongside other threatened specifies and ecological communities), significant land-clearing activities, significant water resources (in addition to unconventional gas, coal seam gas, and large coal impacts), the National Reserve System, nationally important ecosystems (key biodiversity areas and areas of high conservation value), and significant greenhouse gas emissions. I welcome the expansion of the water trigger to cover all forms of unconventional gas, in addition to coal seam gas and large coal mining development. However, there is a clear policy gap in that emissions-intensive activities are not currently considered as a matter of national environmental significance under the Act. The addition of a ‘climate trigger’ to the list of MNES, would ensure that high emitting projects, or project extensions, could be assessed, approved, or rejected, based on their emissions contribution. A climate trigger would allow the consideration of the amount of greenhouse gas an action would emit in considering whether a proposed action can be approved. [2] The Safeguard Mechanism as the primary legislative mechanism to reduce greenhouse gas emissions in Australia’s industrial sector is purported to be the key mechanism to manage proposed actions resulting in significant greenhouse emissions. However, the Safeguard Mechanism is insufficient and ill-suited to considering the impact of fossil fuels and climate change on the environment. The threshold for the Safeguard Mechanism is currently greater than 100,000 tonnes of CO2-e annually of Scope 1 emissions only. Furthermore, it appears not to consider land use change, such as significant land clearing. This is grossly insufficient in addressing greenhouse gas emissions in Australia. For example, Newcastle Port exports around 160 million tonnes of thermal coal each year. [3] The combustion of this which equates to around 400 Mt CO2-e emissions per annum.[4] The total measured Newcastle LGA GHG emissions that in theory could be subject to the safeguard mechanism is equivalent to only 0.5% of emissions resulting from the use of exported coal from Newcastle Port. Putting it more starkly, the emissions resulting from the export of coal through Newcastle Port are equivalent to 3.4 times the emissions for the whole of NSW and just short of the total measured GHG emissions for Australia (401.4 Mt CO2-e for 2020/21). [5] None of the 400 Mt CO2-e emissions are subject to the safeguard mechanism. Stating the obvious, the environment is impacted by increased GHG emissions whether they are Scope 1, 2 or 3. Projects projected to have over greater than 100,000 tonnes of CO2-e per year including Scope 3 emissions, should be captured by a Climate Trigger. Furthermore, a Climate Trigger would prevent new entrants to the Safeguard Mechanism reducing increases in GHG emissions, decrease pressure on existing facilities subject to the Safeguard Mechanism resulting from less overall reductions in the Safeguard Mechanism and reduce administration overheads of ongoing management on new entrants. A Climate Trigger would complement the Safeguard Mechanism and other legislation such as the Climate Change Act and would likely capture several high GHG projects that the Safeguard Mechanism would miss. Australia continues to remain the only developed nation in the world listed as a deforestation hotspot and ranks 5th in the world in deforestation rate. [6] Beef cattle farms are responsible for almost 75% of all deforestation. 862 plants and 286 animals listed as threatened have deforestation and resulting habitat fragmentation or degradation listed as threats.[7] Since 2000, Australia has lost 21% of its tree cover, representing 8.85 million Ha and 2.16 Gt of Co2-e emissions. NSW had the lions share of this at 3.01 million Ha lost.[8] The recent 6th Assessment Report of the Intergovernmental Panel on Climate Change (IPCC) detailed the opportunities for scaling up climate action through mitigation options. They found that, like replacing fossil fuels with wind and solar, the reduction in the destruction of natural ecosystems was one of the most effective methods of climate mitigation, with a potential contribution to emission reduction of over 4 Gt of Co2-e emission per annum.[9] The addition of a ‘land clearing trigger’ to the list of MNES, would ensure that projects, or project extensions that would result in land-clearing in areas over a designated size that may contain listed threatened species would be assessed, approved, or rejected, based on their potential impact. A land clearing trigger would ensure land clearing would be subject to the same regulations as other areas withing the nature laws. Threatened species need our protection regardless of whether they are considered extinct in the wild. Please ensure that species that are listed as extinct in the wild remain part of our environment laws as a MNES. National Environmental Standards New strong legally enforceable National Environmental Standards should form the basis of reforms to Australia’s environment laws to ensure all decisions lead towards improved national environmental outcomes.[10] The environmental standards, through use of best practices should be subject to continuous improvement and non-regression to allow adaptation to pressures on the environment such as land clearing and climate change. With my involvement with the Mined Land Rehabilitation Conferences, I have seen the effects of cumulative approvals of mines and mine expansion in the Hunter Valley on the environment, the decreased resilience to change, the health impact on individuals living and working within the area. For example, there is a cumulative issue relating to air quality in the Upper Hunter that needs attention. Average levels of coarse particle pollution in the Hunter Valley have increased at a rate higher than the rest of NSW. Air quality in the local area has been deteriorating over time, reaching 470 air quality alerts in 2019 prior to the bushfires. The top three for PM10 particulate levels of air pollution in NSW are in the local area. This air pollution contributes to heart disease, stroke, deaths, diabetes, low birth weight for babies, restricted lung growth in children, lung cancer in non-smokers, asthma, and emphysema. For example, a recent planned expansion of an open-cut coal mine in the area would exacerbate an already dire set of circumstances with respect to air quality and health issues in the local area. However, the mine expansion went ahead as cumulative impacts are not considered in planning laws. The new Nature Laws needs to explicitly consider cumulative impacts of past, present and future developments and decisions. The use of strategic assessments and regional planning may assist in assessing cumulative impacts. The Samuel review recommended that the full suite of National Environmental Standards be developed and implemented. Standards for Threatened Species and Ecological Communities as detailed in the review need to be included in our new Nature Positive Laws. These include:

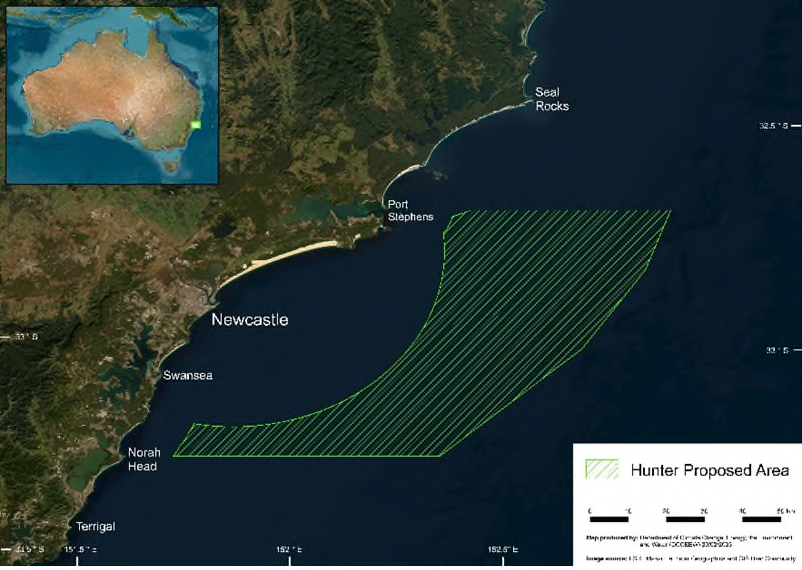

Furthermore, “Nature positive outcome” must relate to each individual threatened species or ecological community and not be some net positive outcome across all species. Climate change The impacts of climate change on the environment are significant and severe. The present scientific consensus is that the earth's climate is warming due to human activity, and the negative impacts of increased greenhouse gas emissions are measurable globally and nationally.[11] Australia’s climate has warmed on average by 1.47 ± 0.24 °C since national records began in 1910, which has led to an increase in the frequency of extreme heat events.[12] The Bureau of Meteorology and CSIRO reported that there has been an increase in extreme fire weather, and in the length of the fire season, across large parts of the country since the 1950s, as evidenced by the catastrophic bushfires in the summer of 2019/2020. They also noted changes in rainfall, with decreases in the southeast and southwest of Australia as shown by the devastating drought in 2019. Oceans around Australia they stated are acidifying and have warmed by about 1°C since 1910 bringing longer and more frequent marine heatwaves. In the past 5 years there have been three major mass-bleaching events at the Great Barrier Reef resulting from these marine heatwaves, and resulting in the destruction of over half of the reef’s corals.[13] The Great Barrier Reef has an economic, social and iconic asset value estimated at $56 billion, contributes around $6.4 billion annually to the Australian economy and supports over 64,000 jobs. [14] Sea levels are also rising around Australia, increasing the risk of coastal inundation and damage to infrastructure and communities. The government is responsible for the environment, the health and wellbeing of its citizens, and the financial security of the nation. As we see the impact of increased carbon emissions, we also find evidence of the deleterious impact on Australian native wildlife, the Australian people and the wealth of the nation. To address the issue of dangerous climate change, Australia, along with 196 other parties, is a signatory to the Paris Agreement, which entered into force on 4 November 2016. The Paris Agreement aims to strengthen the global response to the threat of climate change, by: Holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels, recognising that this would significantly reduce the risks and impacts of climate change.[15] In 2020 Australia emitted 1.1% of world greenhouse gas emissions. This made Australia the world’s 16th biggest emitter of greenhouse gas pollution, despite having just 0.33% of world population.[16] On a per capita basis. Australian emissions are the highest in the OECD and among the highest in the world. The only countries with higher per capita emissions than Australia are smaller petro-states like Kuwait, Qatar and UAE and some Small Island Developing States. [17] [18] [19] The IPCC stated that global emissions need to reach net zero by 2050 to be consistent to limiting warming to 1.5 °C.5 The Australian Government has now committed to developing a 2050 Net Zero plan and 2035 emission reduction targets consistent with Australia’s international and domestic commitments.[20] However, since May 2022, 4 new coal mines or expansions were approved in Australia that will result in an additional 156 million tonnes of carbon emissions. An additional 25 additional proposals for new or expanded coal mines are currently awaiting Federal Government approval. All up the 29 new coal mines would release over 12 billion tonnes of carbon emissions if approved.[21] The International Energy Agency (2021) stated that to achieve net zero by 2050, no new oil and gas fields can be approved for development together with no new coal mines or mine extensions.[22] As the new Nature Positive Laws will regulate approvals of new fossil fuel projects, the new laws and standards should be sufficient to prevent projects that result in high emissions and consequently impact the climate and damage biodiversity. The new laws must recognise the impact of climate change on the environment and the requirement to reduce emissions in line with the Paris Agreement. Climate change considerations need to be embedded into all aspects of the new Nature Positive laws, including in decision-making. The contribution of biodiversity to climate change mitigation, the importance of adaptation and resilience, and need to protect carbon sinks also need to be prioritised. Of the natural ecosystems that need protection to mitigate climate change, carbon sinks are the most effective. Significant carbon sinks in Australia include natural forests, savannas, the vast arid to semi-arid areas, coastal ecosystems such as mangroves, tidal marshes, seagrasses, and kelp forests. The new Nature Positive Laws need to increase protection of such carbon-rich ecosystems, particularly for those that are under threat. As stated above, the impact to the environment from climate change is independent of what country the GHG emissions from a project are produced. Therefore, a project or an extension to an existing project that is going to result in increased emissions needs to be evaluated based on total emissions (Scope 1, 2, and 3). Therefore, developers should be required to provide an upfront estimate of all emissions associated with the project (not just domestic ones) and this should be made publicly available. Following the 2019/2020 catastrophic bushfires, koala populations are at a crisis point and it is imperative that urgent action be taken to ensure the survival of this iconic species within south-eastern Australia. Climate change is predicted to affect koala habitat conditions and cause more severe weather conditions (such as the recent severe drought and catastrophic bushfires) which will impact koala survival rates. Climate change is predicted to affect koala habitat by altering the structure and chemical composition of koala food trees, changing the composition of plant communities, and changing the range of important habitat species. In my local area, changing sea levels because of climate change will impact on low lying priority habitat within the Port Stephens area and Stockton Bight, further fragmenting habitat stands. The ability of Koalas to migrate because of climate change are impacted by the connectivity across the landscape. Particular attention is required to remove or mitigate the barriers to connectivity and to preserve and enhance existing connectivity, such as undertaken in the Hunter Valley with the Great Eastern Ranges initiative. For example, regional and local conservation planning should consider protecting existing connectivity and enhancing connectivity of koala habitat patches that are within 100m of another patch.[23] Climate change considerations need to be included in the new Nature Laws to identify and protect habitat and corridors that will support species resilience to more extreme heat and natural disasters, even if there is no population in those areas now. To be able to protect at risk carbon sinks, climate refuge habitat, and climate corridors, areas subject to Regional Forest Agreements must be subject to the new National Environmental Standards once implemented to prevent further destruction. Community engagement To ensure government accountability and effective decision making, greater public transparency is required together with effective community consultation and the right of appeal. Decisions should be informed by community engagement (including public submissions) and the reasoning behind the decisions documented, including how community feedback was incorporated, and provided back to the community. Specifically, the new Nature Laws should provide information on policies, policy changes, and specific assessments, decisions, and actions to the public in a timely and accessible manner. It should not be necessary to undertake lengthy and expensive FOI requests to get the reasoning behind decisions. The right of appeal should extend to the courts with judicial review of government decisions such that is available in the states. Similarly interested parties should be able to seek merits review of decisions as detailed in the Samuel review. The community consultation process should be strengthened to ensure developers meet standards for effective community engagement and this is reviewed by the EPA to ensure effective engagement is undertaken throughout the process. For example, how communities’ views were considered need to be explained by developers. Community feedback also needs to be considered at each stage of the decision-making process. Conservation planning The new laws introduce the concept of unacceptable impacts which is a good thing. However, these need to be clearly defined, include damage to critical habitats, and capture impacts that are likely to occur as well as those that will occur. As unacceptable impacts relate to the viability of the species, this also needs clear definition, such as that a species is not in decline. The concept of critical habitat needs to be retained as it has an existing and accepted meaning. In addition, it has legal standing. Critical protection areas providing hard protections for habitat essential for the survival of a species are a good thing. Critical habitat should be protected within a Critical protection area and not be subject to damage or destruction or able to be offset. Critical protection areas only work if their implementation is mandatory. Environment Information Australia & Environment Protection Australia The Samuel review noted that decision-makers, developers, and the public do not have access to the best available data, information, and science, resulting in substandard decisions, additional costs to business and poor transparency. With the new body Environment Information Australia providing environmental data for use in assessing environmental impacts, decision making, this should require the use of the best available science to ensure the new Environment Laws result in decision making is firmly grounded on science, and not on influence or politics. The new Environment Protection Australia authority as the chief environmental regulator and to assess and approve projects, monitor compliance, and take enforcement action and is a good thing. The EPA needs to be able to independently assess impacts on the environment based on the best available science, be properly resourced, have sufficient time to make assessments, and be able to act without political interference. The CEO of the EPA should be accountable to an independent board of directors. The proposed “call-in powers” by the Minister undermines both the EPA and environmental protection strategies. Similar things in the past through the EPBC Act have been subject to abuse. I am not sure how this would not happen again. Decision Making Environmental assessments and approvals need an effective, robust, and fair process using rules-based, science-based decision-making, not the current system using disproportionate decision-maker discretion resulting in sub-optimal outcomes for the environment. This should not continue with the new system. Decisions should be based on the best available science. If the science shows that a project will likely have unacceptable impacts to the environment, then the project should not go ahead. Pretty simple. Furthermore, decisions or projects must be compliant with the National Environmental Standards, not just be “not inconsistent with” the standards. Moreover, environmental assessments and approvals need to be compliant with the Precautionary Principle not just take it into consideration. If a project or project-extension has the potential to have significant environmental impact it should not be allowed to utilise the low-impact pathway and be required to go through a proper assessment. For controversial or complex projects, a more flexible assessment option may be warranted, the option to conduct an assessment by public inquiry should be available. Accreditation I am concerned with the proposed accreditation of states and third parties for decision making (not assessment). We have a bad track record of this. The Samuel interim report noted that past attempts to devolve decision-making had been unsuccessful due to “lack of defined outcomes and concerns that decisions would be inconsistent with the national interest.” State and territory laws were not designed to address matters of national environmental significance nor adequately address the current national environmental standards encompassed in the EPBC Act. Significant law reform would be required together with substantial resourcing to ensure national standards were applied consistently. An analysis of 30 case studies across the country illustrated how state and territory laws, processes and policies do not meet current national standards nor provide assurances of delivery of environmental outcomes under such a system devolved responsibility. [24] It found that state and territory laws do not adequately address cumulative impacts, cross border impacts, or adequately implement international obligations. There was also no guarantee that national standards would be implemented. The audit and case studies highlight the need for comprehensive legislation and governance reform at all levels, and the importance of the Commonwealth taking a long-term primary role in the effective management of the environment to protect our unique environment. With a well-resourced and effective EPA supported by the best available data through Environment Information Australia and clear National Environmental Standards and Laws, quick and effective decisions can be made without compromising environmental protection. Accreditation for decision making adds complexity and risk to the process and may result in substandard decisions impacting deleteriously on the environment and should be avoided. Regional planning and strategic assessments Regional planning and strategic assessments provide for consideration of cumulative impacts at a landscape phase. This is a good thing. These should include cumulative climate impacts and future climate scenarios. These regional plans and strategic assessments will be essential for the renewable energy transition. This will allow for the opportunity to consult early and strategically on the appropriate siting of renewable energy projects.[25] The ability of the minister to use call-in powers to approve a regional plan with substandard environmental outcomes seems a dangerous move. It is one thing to call in an individual project but something else to apply this to regional plans. Regional plans are to improve protection and restoration of priority conservation areas and not the other way around. Furthermore, this should not be a short-cut for approval of projects where there are potentially significant impacts on a MNES. In addition, offsets should not be able to be applied under regional plans and should be specific to species being impacted by an individual project or project extension. Similarly weaker offsets or financial offsets should not be allowed. And lastly, regional planning should not allow for exemptions for specific sectors – such as native forest logging. Other - Offsets Offsets should be a last resort. Offsetting should only be allowed in limited circumstances using best available science. The proposal for like-for-like offsetting is a good thing. In addition, the quality of the offsite site should be as good or better than the site being impacted. Furthermore, some things cannot be offset such as critical habitat for all threatened species, all World Heritage places. National Heritage places, and Ramsar wetlands. This needs to be reflected in the new Nature Laws. Financial offsets (restoration contributions) should not be permitted. This is a bad move and a retrograde step from the EPBC Act. You should not be able to buy your way out of protecting the environment. This will likely lead to the extinction of some threatened species, ecological communities, and migratory species. Other – pre-emptive carve-out of the NOPSEMA endorsed program from existing accreditation laws Offshore gas extraction poses significant risks to our oceans, reefs, and marine life, and it also contributes significantly to climate damage, impacting Australian communities and our natural environment. The proposal to exempt offshore gas projects from scrutiny under Australia’s new Nature Positive laws through the proposed addition of section 790E to the Offshore Petroleum and Greenhouse Gas Storage Act 2006 (Cth) (OPGGS Act) undermines the environmental laws and standards being discussed here while granting offshore oil and gas companies streamlined approvals. We should focus on strengthening environmental laws, not weakening them. The proposed amendment appears to allow regulatory changes under the OPGGS Act not to trigger a review of accreditations under the existing endorsed NOPSEMA program through the EPBC Act. Without any safeguard, changes to regulations and legislation that may be deleterious to the environment, climate, and people of Australia would be automatically included under the existing NOPSEMA accreditation program without any scrutiny or recourse. Furthermore, it is unclear how this bill would interact with the proposed new nature positive laws. Thank you for your consideration of my submission. Sincerely, Alec Roberts Chair CLEANaS [1] Samuel, G, (2020). Independent Review of the EPBC Act—Interim Report, Department of Agriculture, Water and the Environment, Canberra, June. CC BY 4.0. [2] Parliament of Australia. (2024, February). Environment Protection and Biodiversity Conservation Amendment (Climate Trigger) Bill 2022 [No. 2] Report – February 2024. The Senate. Environment and Communications Legislation Committee. https://www.aph.gov.au/Parliamentary_Business/Committees/Senate/Environment_and_Communications/ClimateTriggerBill2022/Report [3] Port of Newcastle. (2022). Trade Report 2022. Retrieved 16 October 2023, from https://www.portofnewcastle.com.au/wp-content/uploads/2023/04/20230404-Annual-Trade-Report-2022-1.pdf [4] Department of Climate Change. (2008) National Greenhouse Accounts (NGA) Factors. Retrieved 16 October 2023, from http://www.globalbioenergy.org/uploads/media/0801_Australia_-_National_Greenhouse_Accounts__NGA__factors.pdf [5] Department of Climate Change, Energy, the Environment and Water (DCCEEW) (2023). Australian National Greenhouse Accounts Factors, Australian Government Department of Climate Change, Energy, the Environment and Water. Retrieved 16 October 2023, from https://www.dcceew.gov.au/climate-change/publications/national-greenhouse-accounts-factors-2023 [6] Cox, L. (2021). Australia the only developed nation on world list of deforestation hotspots. https://www.theguardian.com/environment/2021/jan/13/australia-the-only-developed-nation-on-world-list-of-deforestation-hotspots [7] Thorpe, D. (2023). Deforestation: how does Australia fare in global comparisons? https://thefifthestate.com.au/business/deforestation-how-does-australia-fare-in-global-comparisons/ [8] Global Forest Watch. (2024). Tree cover loss in Australia. Accessed on 27/03/2024. Retrieved from www.globalforestwatch.org [9] Intergovernmental Panel on Climate Change (IPCC). (2023). Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change. Retrieved from https://www.ipcc.ch/report/ar6/syr/ [10] Samuel, G, (2020). Independent Review of the EPBC Act—Final Report, Department of Agriculture, Water and the Environment, Canberra, October. CC BY 4.0. [11] NASA (n.d.) Scientific Consensus: Earth's Climate is Warming. Retrieved from https://climate.nasa.gov/scientific-consensus/ [12] BOM (2022) State of the Climate 2022. Retrieved from http://www.bom.gov.au/state-of-the-climate/2022/documents/2022-state-of-the-climate-web.pdf [13] Readfearn, G. (2020, April 7). Great Barrier Reef's third mass bleaching in five years the most widespread yet. Retrieved from https://www.theguardian.com/environment/2020/apr/07/great-barrier-reefs-third-mass-bleaching-in-five-years-the-most-widespread-ever [14] Deloitte Access Economics (2017, June 23). At what price? The economic, social and icon value of the Great Barrier Reef. Retrieved from https://www.barrierreef.org/the-reef/the-value [15] IPCC (2018). Global Warming of 1.5°C: An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty, Intergovernmental Panel on Climate Change. Retrieved from https://www.ipcc.ch/sr15/ [16] World Population Review. (2023). CO₂ Emissions by Country 2023. Retrieved 23 November 2023, from https://worldpopulationreview.com/country-rankings/co2-emissions-by-country [17] Swann, T. (2019, July). High Carbon from a Land Down Under: Quantifying CO2 from Australia’s fossil fuel mining and exports. Retrieved from https://www.tai.org.au/sites/default/files/P667%20High%20Carbon%20from%20a%20Land%20Down%20Under%20%5BWEB%5D_0_0.pdf [18] Ritchie, H. (2019, October 4). Where in the world do people emit the most CO2? Retrieved from https://ourworldindata.org/per-capita-co2 [19] Statistica. (2023). Per capita carbon dioxide emissions worldwide in 2021, by country. Retrieved 23 November 2023, from https://www.statista.com/statistics/270508/co2-emissions-per-capita-by-country/ [20] Department of Climate Change, Energy, the Environment and Water (DCCEEW). (2023). Net Zero, Australian Government Department of Climate Change, Energy, the Environment and Water. Retrieved 23 November 2023, from https://www.dcceew.gov.au/climate-change/emissions-reduction/net-zero [21] The Australia Institute. (n.d). Project Coal Mine Tracker. Retrieved 23 November 2023 from https://australiainstitute.org.au/initiative/coal-mine-tracker/ [22] IEA. (2021). Net Zero by 2050. A Roadmap for the Global Energy Sector. Retrieved from https://www.iea.org/reports/net-zero-by-2050 [23] Eco Logical Australia (2013). Lower Hunter Koala Study. Prepared for Dept Sustainability, Environment, Water, Population and Communities’. [24] EDO. (2020). Devolving Extinction: The risks of handing environmental responsibilities to state & territories. https://www.edo.org.au/2020/10/05/devolving-extinction-the-risks-of-handing-environmental-responsibilities-to-state-territories/ [25] Walmsley, R. (2023). A new pathway for the renewable energy transition: national environment laws that deliver for nature, climate and communities. https://www.edo.org.au/2023/09/26/a-new-pathway-for-the-renewable-energy-transition-national-environment-laws-that-deliver-for-nature-climate-and-communities/

0 Comments

Letter to Hon. Madeline King, Resources Minister Re: Offshore Petroleum and Greenhouse Gas Storage Legislation Amendment (Safety and Other Measures) Bill 2024 |

| Without global vigilance around net-zero pledges and offsets, they are likely to be used as greenwashing and distraction by companies that aren’t prepared to lose profits to take the action necessary to help solve the climate crisis (Morgan, 2021). |

Carr (2022) noted that whereas carbon credits are a way to reduce carbon emissions and to quantify emissions and pollutants and therefore are a step in the right direction, just like most ideas, loopholes have turned carbon credits into a bookkeeping trick with credits used as a greenwashing tactic that allow companies to mislead customers without making any significant improvements to their business model. Armistead and Hemming (2023) noted that “buying carbon credits year after year means that a business is not making the changes they need to legitimately help decarbonise the economy”.

The Australia Institute (2023) poll found that around half of Australians surveyed (48%) agreed that carbon offsets are greenwash and about three in five Australians (62%) agreed that carbon offsets help polluters look like they are reducing emissions even when they aren’t.

Dyke, et al (2021) declared that the concept of net zero has given licence to a “burn now, pay later” approach which has seen emissions continue to soar. These market based approaches have been a windfall to the fossil fuel industry, emissions from which have only grown since offsetting approaches began (Kuch, 2022).

The Australia Institute (2023) poll found that around half of Australians surveyed (48%) agreed that carbon offsets are greenwash and about three in five Australians (62%) agreed that carbon offsets help polluters look like they are reducing emissions even when they aren’t.

Dyke, et al (2021) declared that the concept of net zero has given licence to a “burn now, pay later” approach which has seen emissions continue to soar. These market based approaches have been a windfall to the fossil fuel industry, emissions from which have only grown since offsetting approaches began (Kuch, 2022).

Offsets should be a last resort

Even according to the Australian government, the process of offsetting should be a last resort, with avoiding, reducing and substituting fossil fuels undertaken prior to considering offsetting (Feik, 2023).

Despite all these issues, offsetting can still have a small role, as some emissions cannot be avoided or reduced at present, given low-emissions technologies for industries like steelmaking and cement manufacturing are still scaling up (Morgan, 2023). However, these offsets must be strictly limited and set to progressively decline over time, as opportunities for genuine emissions reductions at the source are developed and implemented across industry (Morgan, 2023).

Morgan (2023) declared that offsets are not a solution and there is no substitute to actually ending the routine burning of fossil fuels. “The atmosphere doesn’t respond to good intentions or clever schemes. All it responds to is the volume of greenhouse gases which trap ever more heat” (Morgan, 2023).

Mowery (2022) sums it up, net zero is a first step for companies to become more environmentally friendly; however, it is not the optimal end result. “Organisations must strive to reach real or true zero emissions to be truly sustainable and do their best to keep the planet in conditions that will allow society and all life to thrive.”

Despite all these issues, offsetting can still have a small role, as some emissions cannot be avoided or reduced at present, given low-emissions technologies for industries like steelmaking and cement manufacturing are still scaling up (Morgan, 2023). However, these offsets must be strictly limited and set to progressively decline over time, as opportunities for genuine emissions reductions at the source are developed and implemented across industry (Morgan, 2023).

Morgan (2023) declared that offsets are not a solution and there is no substitute to actually ending the routine burning of fossil fuels. “The atmosphere doesn’t respond to good intentions or clever schemes. All it responds to is the volume of greenhouse gases which trap ever more heat” (Morgan, 2023).

Mowery (2022) sums it up, net zero is a first step for companies to become more environmentally friendly; however, it is not the optimal end result. “Organisations must strive to reach real or true zero emissions to be truly sustainable and do their best to keep the planet in conditions that will allow society and all life to thrive.”

References

Armistead, A., & Hemming, P. (2023). The Safeguard Mechanism and the junk carbon credits undermining emission reductions. The Australia Institute. Retrieved 11 March 2023, from https://Australiainstitute.org.au/post/the-safeguard-mechanism-explained/

Bernoville, T. (2022). What is the difference between carbon-neutral, net-zero and climate positive?. planA. Retrieved 14 March 2023, from https://plana.earth/academy/what-is-difference-between-carbon-neutral-net-zero-climate-positive

Carr, B. (2022, April 21). Exposing the Carbon Credit and Offset SCAM. [Video]. YouTube. https://www.YouTube.com/watch?v=A5GAaCTwc9s

Climate Active. (2019). Carbon offsets. Retrieved 14 March 2023, from https://www.climateactive.org.au/what-climate-active/carbon-offsets

Dyke, J., Watson, R., & Knorr, W. (2021). Climate scientists: concept of net zero is a dangerous trap. The Conversation. Retrieved 13 March 2023, from https://theconversation.com/climate-scientists-concept-of-net-zero-is-a-dangerous-trap-157368

Feik, N. (2023). The great stock ’n’ coal swindle. The Monthly. Retrieved 13 March 2023, from https://www.themonthly.com.au/issue/2023/march/nick-feik/great-stock-n-coal-swindle#mtr

Kuch, D. (2022). Now we know the flaws of carbon offsets, it’s time to get real about climate change, The Conversation. Retrieved 11 March 2023, from https://theconversation.com/now-we-know-the-flaws-of-carbon-offsets-its-time-to-get-real-about-climate-change-181071

Lyons, K., & Ssemwogerere, D. (2017). Carbon Colonialism: The Failure of Green Resources’ Carbon Offset Project in Uganda. The Oakland Institute. Retrieved 14 March 2023, from https://www.oaklandinstitute.org/sites/oaklandinstitute.org/files/uganda_carbon_colonialism.pdf

Morgan, J. (2021). Why carbon offsetting doesn't cut it. World Economic Forum. Retrieved 16 March 2023, from https://www.weforum.org/agenda/2021/09/greenpeace-international-carbon-offsetting-net-zero-pledges-climate-change-action/

Morgan, W. (2023). A tonne of fossil carbon isn’t the same as a tonne of new trees: why offsets can’t save us. The Conversation. Retrieved 11 March 2023, from https://theconversation.com/a-tonne-of-fossil-carbon-isnt-the-same-as-a-tonne-of-new-trees-why-offsets-cant-save-us-200901

Mowery, L. (2022). Net Zero vs Real Zero Emissions and What It Means for Your Business’ Goals. Green Business Bureau. Retrieved 14 March 2023, from https://greenbusinessbureau.com/topics/carbon-accounting/net-zero-vs-real-zero-emissions-and-what-it-means-for-your-business-goals/

National Grid ESO. (n.d.). What is net zero and zero carbon?. nationalgridESIO. Retrieved 16 March 2023, from https://www.nationalgrideso.com/future-energy/net-zero-explained/net-zero-zero-carbon

Nature-based Solutions Initiative. (2021). On the misuse of nature-based carbon ‘offsets’. Retrieved 16 March 2023, from https://www.naturebasedsolutionsinitiative.org/news/on-the-misuse-of-nature-based-carbon-offsets

Our Changing Climate. (2018, November 15). Can carbon offsets really save us from climate change?. [Video]. YouTube. https://www.YouTube.com/watch?v=xdW-6MXB0sI

Pipkorn, J., Reardon, C., & Dwyer, S. (2020). Zero energy and zero carbon homes. YourHome. Retrieved 14 March 2023, from https://www.yourhome.gov.au/live-adapt/zero-carbon

The Australia Institute. (2023). Polling – Carbon neutrality, net zero and carbon offsets. Retrieved 11 March 2023, from https://Australiainstitute.org.au/wp-content/uploads/2023/02/Polling-January-2023-Carbon-neutrality-net-zero-offsets-Web.pdf

Bernoville, T. (2022). What is the difference between carbon-neutral, net-zero and climate positive?. planA. Retrieved 14 March 2023, from https://plana.earth/academy/what-is-difference-between-carbon-neutral-net-zero-climate-positive

Carr, B. (2022, April 21). Exposing the Carbon Credit and Offset SCAM. [Video]. YouTube. https://www.YouTube.com/watch?v=A5GAaCTwc9s

Climate Active. (2019). Carbon offsets. Retrieved 14 March 2023, from https://www.climateactive.org.au/what-climate-active/carbon-offsets

Dyke, J., Watson, R., & Knorr, W. (2021). Climate scientists: concept of net zero is a dangerous trap. The Conversation. Retrieved 13 March 2023, from https://theconversation.com/climate-scientists-concept-of-net-zero-is-a-dangerous-trap-157368

Feik, N. (2023). The great stock ’n’ coal swindle. The Monthly. Retrieved 13 March 2023, from https://www.themonthly.com.au/issue/2023/march/nick-feik/great-stock-n-coal-swindle#mtr

Kuch, D. (2022). Now we know the flaws of carbon offsets, it’s time to get real about climate change, The Conversation. Retrieved 11 March 2023, from https://theconversation.com/now-we-know-the-flaws-of-carbon-offsets-its-time-to-get-real-about-climate-change-181071

Lyons, K., & Ssemwogerere, D. (2017). Carbon Colonialism: The Failure of Green Resources’ Carbon Offset Project in Uganda. The Oakland Institute. Retrieved 14 March 2023, from https://www.oaklandinstitute.org/sites/oaklandinstitute.org/files/uganda_carbon_colonialism.pdf

Morgan, J. (2021). Why carbon offsetting doesn't cut it. World Economic Forum. Retrieved 16 March 2023, from https://www.weforum.org/agenda/2021/09/greenpeace-international-carbon-offsetting-net-zero-pledges-climate-change-action/

Morgan, W. (2023). A tonne of fossil carbon isn’t the same as a tonne of new trees: why offsets can’t save us. The Conversation. Retrieved 11 March 2023, from https://theconversation.com/a-tonne-of-fossil-carbon-isnt-the-same-as-a-tonne-of-new-trees-why-offsets-cant-save-us-200901

Mowery, L. (2022). Net Zero vs Real Zero Emissions and What It Means for Your Business’ Goals. Green Business Bureau. Retrieved 14 March 2023, from https://greenbusinessbureau.com/topics/carbon-accounting/net-zero-vs-real-zero-emissions-and-what-it-means-for-your-business-goals/

National Grid ESO. (n.d.). What is net zero and zero carbon?. nationalgridESIO. Retrieved 16 March 2023, from https://www.nationalgrideso.com/future-energy/net-zero-explained/net-zero-zero-carbon

Nature-based Solutions Initiative. (2021). On the misuse of nature-based carbon ‘offsets’. Retrieved 16 March 2023, from https://www.naturebasedsolutionsinitiative.org/news/on-the-misuse-of-nature-based-carbon-offsets

Our Changing Climate. (2018, November 15). Can carbon offsets really save us from climate change?. [Video]. YouTube. https://www.YouTube.com/watch?v=xdW-6MXB0sI

Pipkorn, J., Reardon, C., & Dwyer, S. (2020). Zero energy and zero carbon homes. YourHome. Retrieved 14 March 2023, from https://www.yourhome.gov.au/live-adapt/zero-carbon

The Australia Institute. (2023). Polling – Carbon neutrality, net zero and carbon offsets. Retrieved 11 March 2023, from https://Australiainstitute.org.au/wp-content/uploads/2023/02/Polling-January-2023-Carbon-neutrality-net-zero-offsets-Web.pdf

Media Release - Newcastle can lead the way on climate action: Let’s lead with our votes

Candidates for the Federal seat of Newcastle laid out their commitments to climate action tonight in a forum hosted by local community groups.

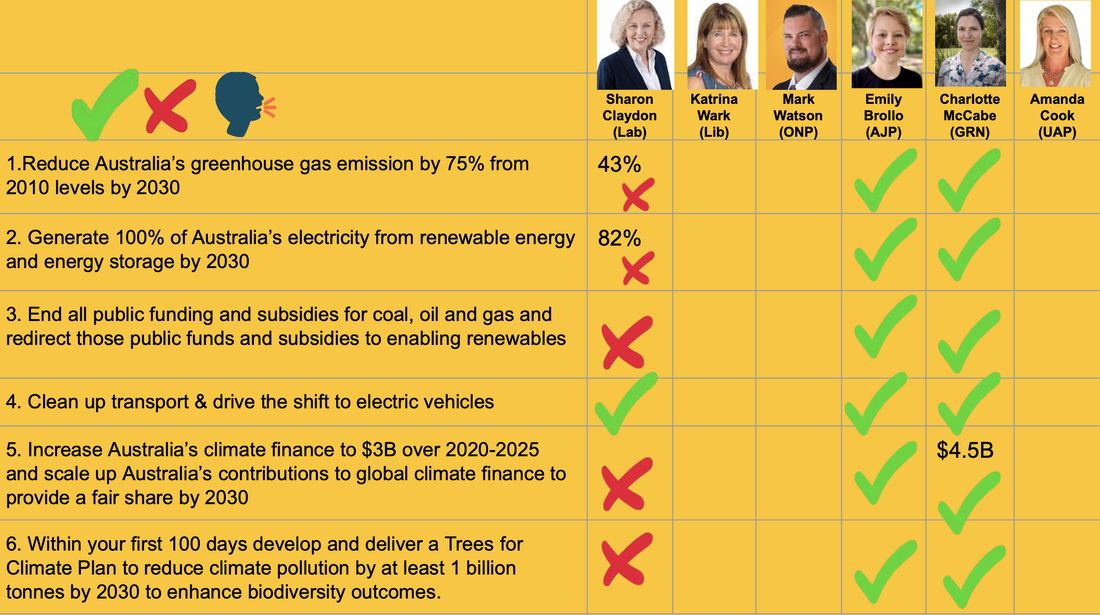

Candidates responded to six climate commitments that are supported by science:

* Reduce Australia’s greenhouse gas emission by 75% from 2010 levels by 2030

* Generate 100% of Australia’s electricity from renewable energy and energy storage by 2030

* End all public funding and subsidies for coal, oil and gas and redirect those public funds and subsidies to enabling renewables

* Clean up transport and drive the shift to electric vehicles

* Increase Australia’s climate finance to $3B over 2020-2025 and scale up Australia’s contributions to global climate finance to provide a fair share by 2030

* Develop and deliver a Trees for Climate Plan to reduce climate pollution by at least 1 billion tonnes by 2030 and to enhance biodiversity outcomes.

A scorecard that summarises their responses is attached.

Both Charlotte McCabe (Greens candidate) and Emily Brollo (Animal Justice Party) committed to all 6 climate policies. Newcastle’s sitting member, Hon Sharon Claydon, responded no to 5 of the 6 policies, only committing to accelerating Australia’s transition to electric vehicles. Ms Claydon committed to reducing Greenhouse Gas emissions by 43% by 2030 (short of the 75% reduction commitment sought) and to generating 82% of Australia’s energy needs by 2030 (short of the 100% commitment sought).

“I was very disappointed that the Federal member for Newcastle, Sharon Clayon was unable to commit to the decisive climate and energy policies and actions we desperately need to protect Newcastle and the nation,” said Ms Alexa Stuart, School Strike for Climate Action leader.

Ms Claydon spoke in detail about the Australian Labor Party’s election platform, the ‘Powering Australia Plan’. (https://www.alp.org.au/policies/powering-australia)

Candidates from the Liberal Party, One Nation and United Australia Party were invited but declined to participate.

“This is the decisive decade to reduce Greenhouse Gas Emissions by three-quarters, according to the United Nations and the Intergovernmental Panel on Climate Change,” said Jacquie Svenson, convenor of Newcastle Climate Change Response.

“The Newcastle community cares deeply about climate action and it will influence how we vote,” said Ms Svenson. “For decades, Novocastrians have been putting solar on our roofs and advocating a fair and fast transition from fossil fuels.

“Floods, fires and heatwaves are becoming more frequent and intense. Listening to Binnie O’Dwyer tonight from her Lismore home which was flooded twice, we know we need to turn our concern into political action on 21 May.”

Guest speakers at tonight’s forum

Dr Karl Mallon: a leading international expert on climate change physical risk analysis who has worked for 30 years in climate change mitigation, policy and technical analysis worldwide.

Binnie O’Dwyer: normally lives in Lismore with her 2 teenagers and works as a solicitor at the Aboriginal Legal Service. Binnie’s home was flooded twice in the recent extreme weather events and her family are now dispersed.

For comment

Dr Jacquie Svenson, Newcastle Climate Change Response 0434 223 789

Ms Alexa Stuart, School Strikers for Climate Action 0423 361 030

Candidates responded to six climate commitments that are supported by science:

* Reduce Australia’s greenhouse gas emission by 75% from 2010 levels by 2030

* Generate 100% of Australia’s electricity from renewable energy and energy storage by 2030

* End all public funding and subsidies for coal, oil and gas and redirect those public funds and subsidies to enabling renewables

* Clean up transport and drive the shift to electric vehicles

* Increase Australia’s climate finance to $3B over 2020-2025 and scale up Australia’s contributions to global climate finance to provide a fair share by 2030

* Develop and deliver a Trees for Climate Plan to reduce climate pollution by at least 1 billion tonnes by 2030 and to enhance biodiversity outcomes.

A scorecard that summarises their responses is attached.

Both Charlotte McCabe (Greens candidate) and Emily Brollo (Animal Justice Party) committed to all 6 climate policies. Newcastle’s sitting member, Hon Sharon Claydon, responded no to 5 of the 6 policies, only committing to accelerating Australia’s transition to electric vehicles. Ms Claydon committed to reducing Greenhouse Gas emissions by 43% by 2030 (short of the 75% reduction commitment sought) and to generating 82% of Australia’s energy needs by 2030 (short of the 100% commitment sought).

“I was very disappointed that the Federal member for Newcastle, Sharon Clayon was unable to commit to the decisive climate and energy policies and actions we desperately need to protect Newcastle and the nation,” said Ms Alexa Stuart, School Strike for Climate Action leader.

Ms Claydon spoke in detail about the Australian Labor Party’s election platform, the ‘Powering Australia Plan’. (https://www.alp.org.au/policies/powering-australia)

Candidates from the Liberal Party, One Nation and United Australia Party were invited but declined to participate.

“This is the decisive decade to reduce Greenhouse Gas Emissions by three-quarters, according to the United Nations and the Intergovernmental Panel on Climate Change,” said Jacquie Svenson, convenor of Newcastle Climate Change Response.

“The Newcastle community cares deeply about climate action and it will influence how we vote,” said Ms Svenson. “For decades, Novocastrians have been putting solar on our roofs and advocating a fair and fast transition from fossil fuels.

“Floods, fires and heatwaves are becoming more frequent and intense. Listening to Binnie O’Dwyer tonight from her Lismore home which was flooded twice, we know we need to turn our concern into political action on 21 May.”

Guest speakers at tonight’s forum

Dr Karl Mallon: a leading international expert on climate change physical risk analysis who has worked for 30 years in climate change mitigation, policy and technical analysis worldwide.

Binnie O’Dwyer: normally lives in Lismore with her 2 teenagers and works as a solicitor at the Aboriginal Legal Service. Binnie’s home was flooded twice in the recent extreme weather events and her family are now dispersed.

For comment

Dr Jacquie Svenson, Newcastle Climate Change Response 0434 223 789

Ms Alexa Stuart, School Strikers for Climate Action 0423 361 030

Submission to Australian Senate - Oil and gas exploration and production in the Beetaloo Basin

6/7/2021

Submission to Australian Senate - Oil and gas exploration and production in the Beetaloo Basin by Alec Roberts

06/07/2021

Committee Secretary

Senate Standing Committees on Environment and Communications

PO Box 6100

Parliament House

Canberra ACT 2600

E: [email protected]

My concerns about the Oil and gas exploration and production in the Beetaloo Basin, with reference to the Industry Research and Development (Beetaloo Cooperative Drilling Program) Instrument 2021, which provides public money for oil and gas corporations.

Dear Senators,

Thank you for the opportunity to provide a submission into the Industry Research and Development (Beetaloo Cooperative Drilling Program) Instrument 2021 and taking the time to consider my submission.

I was lucky to travel through the Beetaloo Basin on an extended camping holiday with my partner, visiting the many beautiful places including Newcastle Waters, Daly Waters, and further north Mataranka. The natural beauty of the area is stunning, and it made a lasting impression on me.

For the purposes of the Industry Research and Development Act 1986, the Industry Research and Development (Beetaloo Cooperative Drilling Program) Instrument 2021 provides a mechanism for funding for exploration activities to be undertaken in the Beetaloo sub-basin to facilitate gas exploration in the Beetaloo sub-basin and to support the development of the Northern Territory gas industry. The development of Beetaloo Sub-basin to extract natural gas through fracking will have significant Groundwater impacts, Ecological impacts, Climate Change impacts, and the economics and energy security reasons behind the proposed program are flawed, and further government funding should be refused.

Natural gas extraction from the Beetaloo Basin does not appear to be commercially viable either for the domestic or overseas markets. Furthermore, if developed, would result in approximately 39 - 117 million tonnes of greenhouse gases per year (or 22% of Australia’s current emissions)[1], and cannot be permitted because its development would be inconsistent with the remaining carbon budget and the Paris Agreement climate target. This is not consistent with Northern Territory’s climate change policy, the principle of inter-generational equity nor the public interest, as it clearly assumes failure to meet the Paris Agreement temperature goals and worsening climate change impacts for Northern Territory and Australia.

This submission is focused on commercial viability, economics, gas supply and demand, climate change impacts, gas as a transition fuel and alternative fuels to natural gas. However, it would be remiss of me if I did not briefly mention some of the other potential impacts.

Groundwater and ecological impactsA recent CSIRO/GISERA study of stygofauna within aquifers of the Beetaloo Basin not only found species unique to this area but determined a high level of interconnectivity of ground water within the region.[2] The report noted that water flowed very quickly through the aquifer and it was "at potential risk to possible contamination from surface spills from any source". Any potential groundwater contamination caused by developing a fracking industry in the area could spread widely throughout the cattle grazing and horticulture region. [3]

The area is classed as semi-arid with rainfall linked to the north Australian monsoon that almost exclusively occurs between December and March.[4] As such, communities within the area such as Daly Waters, Larrimah, Newcastle Waters, Elliott, and Aboriginal land, pastoral leases, horticultural enterprises, cattle stations and remote Aboriginal communities rely on ground water for their livelihoods. The aquifer is also linked in the north to well know tourist and bird watcher destinations of Katherine, Mataranka, Roper River at Elsey National Park and Red Lily/57 Mile Waterhole.4

Contamination of the aquifer through surface spills or well failure has the potential to significantly affect those living in the area and their livelihoods together with the unique flora and fauna of the region.

Economics

Commercial viabilityNorthern Territory is a remote, high-cost location, with high pipeline transport costs, which will produce high-cost gas, with production costs of about $7.50/gigajoule ($6.39 - $9.17)23 at the well-head compared to around $5/gigajoule for coal seam gas (CSG) and around $3.40 for conventional gas.[5] Add the cost of transportation to Tennant Creek, $3/gigajoule to get it from Tennant Creek, delivery to the east coast gas market will likely cost more than $11/gigajoule.[6] However, wholesale gas prices for the east coast gas market in 2021 are estimated to be approximately $7-$8/gigajoule.[7] Furthermore, recent AEMO forecasts23 for domestic gas consumption for both residential/commercial and industrial sectors see decreases in demand which in turn may keep gas prices down. Without an increase in gas prices, gas from the Beetaloo Basin is predicted to be too expensive for the domestic market.

To export to Japan, Australia’s biggest gas customer, with LNG liquification costs of $4/gigajoule and shipping costs of $0.70/gigajoule, NT gas would cost over $16/gigajoule to deliver6, whereas the Japanese LNG import price is around $11-$12/gigajoule.[8] Effectively the price delivered to the Australian export terminal will be higher than the price required to be delivered as LNG to Japan. Market trends for Japan’s LNG import have shown a continued softening of demand.[9] Therefore it likely that Japanese LNG import price will remain the same or even decrease over time. Supporting this, recent AEMO forecasts23 of LNG export demand for Australia are flat (although LNG forecasts have a history of being overestimated). Without an increase in demand it is unlikely that prices would increase making NT gas too expensive to export.

Therefore, without a large increase in international gas prices the gas will be too expensive for either the international or domestic market.

Gas and the domestic marketGas supply on the east coast of Australia has tripled since 2014. However, domestic gas prices have also tripled in the same period in response to a huge demand for gas for LNG production and export. LNG exporters in Gladstone were unable to supply enough gas from their CSG production wells, with reserves grossly overestimated compared to their supply capacity. This resulted in existing low cost of production gas being redirected to the LNG export market increasing domestic gas prices.[10]

Domestic gas prices in Australia have remained at levels far in excess of international parity prices. Whilst prices have fallen somewhat, they have not fallen by nearly as much as those in Asia or Europe. Domestic prices have remained some 30-40% higher than ACCC calculated export parity prices (a.k.a. "netback" prices).[11] This may be explained as there is a lack of competition in the supply and delivery in the domestic gas market with only 5 producers and 2 pipeline owners. This is compounded with a lack of transparency of gas prices (there is no wholesale gas market with most gas traded bilaterally via contracts) that puts domestic and industrial gas buyers at a disadvantage.10

Consequently, gas has become uncompetitive as a fuel source for power generation in Australia and demand for gas-powered generation has fallen by 59% since 2014.[12] Subsequently, gas-powered generation has been running well below capacity.[13] Not surprising that at present there are no committed new commercial investments in gas-fired power generation.[14] Nevertheless, electricity prices for both households and businesses have been driven up by higher gas prices, because gas-fired power stations typically supply the electricity market during times of peak demand.11 Gas is effectively the price setter in the National Electricity Market; for every $1/GJ increase in the price of gas the price of electricity rises by $11/MWh.12

The CSIRO GenCost report[15] indicated that renewables (wind and solar photovoltaic) with storage (such as pumped hydro) were now cheaper than gas for electricity generation in Australia. As such, it is expected that demand for gas for electricity generation will decline in the future.

One of the key competitive advantages Australian industry has enjoyed has been low energy prices. Energy intensive industries and industries dependent on energy intensive inputs have become less competitive as prices for electricity and gas for combustion have increased. This has forced the closure of some major manufacturing and chemical plants, lead to the offshoring of production and undermined the profitability and viability of other gas users.11 Gas use in manufacturing as a consequence of these prices has fallen by 12% since 2014.12

AEMO forecasts further reductions in gas use as consumers fuel-switch away from gas appliances towards electrical devices, in particular for space conditioning. For example, the Commonwealth and NSW Government are exploring options to free-up gas demand through electrification, fuel switching and energy efficiency. [16]

Fuel switching from gas appliances towards electrical devices can often be more economic. A 2018 study of household fuel choice found that 98% of households with new solar financially favoured replacement of gas appliances with electric. With existing/no solar 60-65% of households still favoured replacement of gas appliances with electric. [17]

In the residential sector, for example, reverse-cycle air-conditioning is expected to reduce gas demand that could have arisen due to gas heating.[18] For those residents who cannot afford the capital costs of replacing gas appliances, these increased prices are leading to a worrying growth in energy poverty in the domestic residential sector. [19]

AEMO in 2018[20] estimated that in industry accounts for 42% of domestic gas demand, gas powered generation accounts for 29% of demand and residences accounted for the remaining 29%.

It should be noted that demand for natural gas has declined over recent years. From 2014 to 2020, domestic annual consumption of natural gas fell by approximately 19 per cent, with the major contributor of this fall in consumption being the reduction in the use of gas for power generation.[21] 23 Whereas domestic demand for gas has fallen for use in manufacturing by 14%, it has dropped by a staggering 59% for power generation by since 2014.12

The AEMO 2020 Gas Statement of Opportunities report[22] stated that their 2020 gas consumption forecast was lower than all previous forecasts for 2023 onwards, largely reflecting a reduced outlook for the LNG sector, along with a muted outlook for gas-powered generation as new utility-scale renewable capacity forecasts were higher than previously forecast. AEMO, in their latest report[23], predicted that domestic gas consumption was likely to decline, “as consumers invest in measures to increase energy efficiency, including switching away from gas consumption.”

Whereas AEMO has predicted no effective change to the level industrial gas use and residential and commercial gas use, demand for gas-powered generation is predicted to continue to fall by over 85% from 2019 levels by 2028.23 [24]

Economic recovery and jobs?It is dubious that projects such as the Beetaloo Basin gas will deliver the goods for an economic recovery. ACIL Allen’s report “The economic impacts of a potential shale gas development in the Northern Territory”[25] noted that between 82 – 252 ongoing jobs (including indirect employment generated by the local spending of the industry) would be created due the capital-intensive nature of the shale gas industry. Similarly, it would increase NT government revenues by only 0 - 29.1 million per year (<1% budget revenue).[26] The industry is not a large employer and pays little or no tax.[27] Analysis by The Australia Institute noted that the gas sector was one of the worst options to choose for mass job creation and that investment in other sectors would create many more jobs.[28]

Climate Change ImpactsThe impacts of climate change on the environment are significant and severe. The present scientific consensus is that the earth's climate is warming due to human activity (https://climate.nasa.gov/scientific-consensus/ ), and the negative impacts of increased greenhouse gas emissions are measurable globally and nationally.[29]

The seven hottest years globally have occurred in the last seven years, with the last decade warmer than any previous decade.[30] Furthermore, nineteen of the hottest years on record occurred in the last twenty years. [31] [32] The average global temperature now exceeds 1°C above pre-industrial (1850-1900) levels and is expected to exceed 1.5°C between 2030 and 2052.34

Australia has warmed faster than the global average and is on average 1.44 ± 0.24°C warmer than when national records began in 1910 with most of the warming occurring since 1950 with every decade since being warmer than the one before.[33] If comparing to a pre-industrial (1850-1900) baseline, then by 2019 Australia had warmed by greater than 1.5°C.30

The government is responsible for the environment, the health and wellbeing of its citizens, and the financial security of the nation. As we see the impact of increased carbon emissions, we also find evidence of the impact on Australian native wildlife, the Australian people and the wealth of the nation as noted by the catastrophic Black Summer bushfires, crippling drought and more recently floods.

To address the issue of dangerous climate change, Australia, along 196 other parties, is a signatory to the Paris Agreement, which entered into force on 4 November 2016. The Paris Agreement aims to strengthen the global response to the threat of climate change, by:

Holding the increase in the global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C above pre-industrial levels, recognizing that this would significantly reduce the risks and impacts of climate change.[34]

The draft climate change policy “Northern Territory Climate Change Response: Towards 2050”[35] details the NT Government’s objective to achieve net-zero emissions by 2050 and outlines NT governments approach to addressing climate risk and harnessing new opportunities, including building on “existing initiatives across the NT to reduce greenhouse gas emissions across all sectors”, in line with NT’s aspirational target of net zero emissions by 2050. It concedes that “all sectors in the Northern Territory need to be engaged to realise the benefits and that the transition to a low-carbon economy needs to be carefully managed to ensure ongoing economic investment in the Northern Territory.”

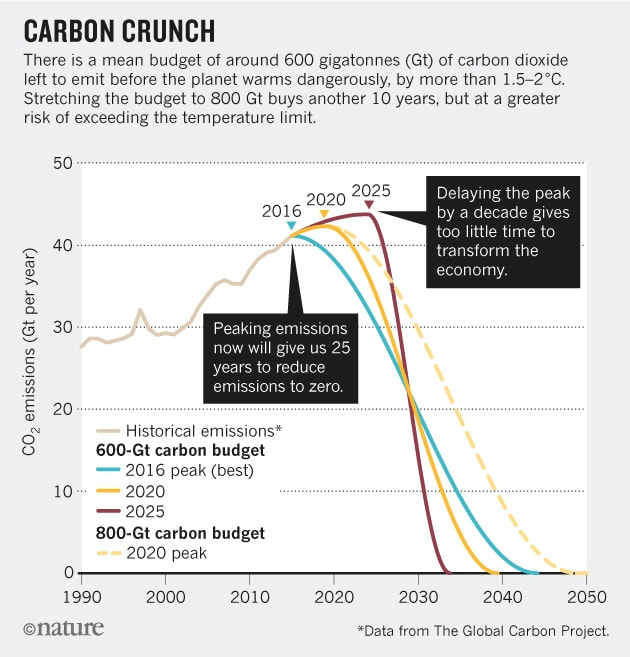

The IPCC report[36] provides an estimate for a global remaining carbon budget of 580 GtCO2 (excluding permafrost feedbacks) based on a 50% probability of limiting warming to 1.5 degrees relative to 1850 to 1900 during and beyond this century and a remaining carbon budget of 420 GtCO2 for a 67% chance.

Committed emissions from existing and proposed energy infrastructure represent more than the entire carbon budget that remains if mean warming is to be limited to 1.5 °C and perhaps two-thirds of the remaining carbon budget if mean warming is to be limited to less than 2 °C. Estimates suggest that little or no new CO2-emitting infrastructure can be commissioned, and that existing infrastructure may need to be retired early (or be retrofitted with carbon capture and storage technology) in order to meet the Paris Agreement climate goals.[37]

Australia’s remaining emission budget from Jan 2017 until 2050 for a 50% chance of warming to stay below 1.5C warming relative to pre-industrial levels was estimated to be 5.5 GTCO2e.36 Adding the GHG emissions expended in 2017[38], 2018[39], 2019[40] and 2020[41], this leaves just 3.3 Gt CO2e remaining as at December 2020. This leaves 6 years left at present emission rates of the 2013-2050 emission budget to stay below 1.5°C. Therefore, at current emissions rates, Australia will have exceeded its carbon budget for 2050 by 2026.

The International Energy Agency report “Net Zero by 2050: A Roadmap for the Global Energy Sector”[42] states that no new natural gas fields are needed for the world to reach net zero by 2050. It therefore follows that no new fossil fuel infrastructure development in Australia that is not carbon neutral, including the Beetaloo Basin gas, that is estimated to result 39 - 117 million tonnes of greenhouse gases each year, can be permitted because its approval would be inconsistent with the remaining carbon budget and the Paris Agreement climate target.

This production of Beetaloo Basin natural gas is not consistent with NT’s climate change policy, the principle of inter-generational equity nor the public interest, as it clearly assumes failure to meet the Paris Agreement temperature goals and worsening climate change impacts for the NT.

Natural gas as a “transition fuel”?

Natural gas has often been touted as the “transition fuel” for the electricity sector to replace coal’s greenhouse gas emissions and eventually paving the way for an emissions free future for Australia. This concept is out of date and I believe incorrect. It is simply too expensive and too emissions intensive to be so.

Fugitive EmissionsMethane leaks from natural gas production can make the process as carbon intensive as coal. The CSIRO report “Fugitive Greenhouse Gas emissions from Coal Seam Gas Production in Australia”[43] noted that fugitive emissions for Natural Gas in Australia as a whole are estimated to be 1.5% of gas extracted. However, they also noted that shale gas emissions were approximately 1.9% higher than conventional gas associated with water flow-back and ‘drill-out’ stages of gas production.

It should be noted that if fugitive emissions exceeded 3.1% then the emissions intensity of gas would match that of coal (due to the fact that methane is 86 times more powerful as a greenhouse gas than CO2 over 20 years and 34 times more powerful over a 100-year time period).14 Therefore based on estimates provided by CSIRO, the emissions intensity of shale gas as proposed for the Beetaloo basin would exceed those for coal and could not be considered a “transition fuel”.

Electricity Market moving away from gasAs noted above, the electricity market has already moved away from gas, with a 59% decline in usage in the National Electricity Market since 2014, whilst renewable energy has increased by 25% during the same period.14 Furthermore, flexible gas plants already in the grid are running well below capacity.13 AEMO forecast that increasing renewable generation developments in the NEM are expected to continue to drive down system normal demand for gas-powered generation. 22

The AEMO modelled the future electricity grid in its Integrated Systems Plan.[44] [45] The results showed for all scenarios that the transition from coal to renewable energy would not be via gas.13 The role of gas would be reduced with a decline in gas generation through to 2040.14 The report notes that to firm up the inherently variable distributed and large-scale renewable generation, there will be needed new flexible, dispatchable resources such as: utility-scale pumped hydro and large-scale battery energy storage systems, distributed batteries participating as virtual power plants, and demand side management.44 45 It also noted that new, flexible gas generators such as gas peaking plants could play a greater role if gas prices materially reduced, with gas prices remaining low at $4 to 6 per GJ.45 However this is unlikely as gas prices have tripled over the past decade and expected domestic gas prices are over 60% more than this price.13 [46] AEMO noted that the investment case for new gas-powered generation will critically depend on future gas prices, as gas-powered generation and batteries can both serve the daily peaking role that will be needed as variable renewable energy replaces coal-fired generation. In their 2020 Gas Statement of Opportunities report, AEMO predicted that as more coal-fired generation retired in the long term, gas consumption for gas-powered generation in the National Electricity Market was forecast to grow again in the early 2030s, recovering to levels similar to those forecast for 2020.20 However, in a later report, AEMO determined that by the 2030s, when significant investment in new dispatchable capacity is needed, new batteries will be more cost-effective than gas-powered generation. 45 Furthermore, the commissioning of the Snowy 2.0 pumped hydro project in 2026 will result in less reliance on gas-powered generation as a source of firm supply.22

AEMO noted that stronger interconnection between regions reduces the reliance on gas-powered generation, as alternative resources can be shared more effectively. 45 The expansion network interconnection enables the growth of variable renewable energy without a significant reliance on local gas generation.[47] Supporting this assertion, the AEMO announced a series of actionable transmission projects including interconnector upgrades and expansions and network augmentations supporting recently announced renewable energy zones.[48] 45 AEMO noted that as each of these new transmission projects is commissioned, the ability for national electricity market regions to share resources (particularly geographically diverse variable renewable energy) is increased, and therefore demand for gas-powered generation is forecast to decrease.22 The Marinus Link is forecast to be commissioned in 2036, with surplus renewable generation from Tasmania then being available to the mainland National Electricity Market, which would see further declines in gas-fired generation, despite continuing coal-fired generation retirements.22

Gas-powered generation can provide the synchronous generation needed to balance variable renewable supply, and so is a potential complement to storage. However, the current installation of synchronous condensers in South Australia and other eastern states to increase system strength and stabilise the electricity network will reduce the need for gas-fired generators acting in the role of synchronous generators as more renewables enter the grid.[49] Ancillary services are likely to utilise battery storage and synchronous condensers in the future and no longer require the use of gas-powered generation.

Transitioning away from Gas

The ACT is planning to go gas free by 2025. This is expected to reduce their overall emissions by 22%. As part of the ACT Climate Change Strategy 2019-2025, all government and public-school buildings will be completely powered by 100% renewable energy eliminating the need for natural gas. The ACT has also removed the mandatory requirement for new homes built in the ACT to be connected to the mains gas network and will begin to introduce new policies to replace gas appliances with electric alternatives. Some 14% of residents have already converted over to 100% electric. [50]

There are moves in other jurisdictions to remove the mandatory requirement for a gas connection in new developments such as in South Australia.

Alternatives to Natural Gas

Several technologies new or new to Australia are expected to reduce the use of natural gas as the Australian economy transitions to a net zero emissions economy and would replace the need for new gas such as proposed for the Beetaloo Basin. Please note that these technologies not only look to transition electricity generation away from natural gas but also for gas combustion for heat. These technologies could also address any gas supply shortfalls.

HydrogenHydrogen is a colourless, odourless, non-toxic gas that is an excellent carrier of energy and can be used for a broad range of energy applications including as a transport fuel, a substitute for natural gas and for electricity generation.[51] Hydrogen gas can be produced from water in a process known as electrolysis, and when powered by renewable energy, the hydrogen produced is free from carbon emissions, making it an attractive way to decarbonise transport, heating and electricity generation.51

AEMO stated that, “Hydrogen has the exciting potential to become an alternative energy storage technology and a new export commodity for Australia” which could be used to help decarbonise the domestic heat, transport and the industrial and commercial sectors in Australia and noted that development of the hydrogen industry would potentially impact both natural gas and electric demands. 44 [52]

Several developments involving green / renewable hydrogen are either planned or underway in Australia.

AEMO highlighted the potential for green steel production in Australia due to abundant renewable resources and the increased demand for low emissions industrial commodities worldwide.52 ‘Green steel’ can be made via a direct reduction process which uses hydrogen (made from renewable energy) as the heat source and reducing agent to produce pig iron. The by-product of the iron reduction process using hydrogen is water, rather than carbon dioxide in conventional steel making. Renewable energy is then used by an electric arc furnace to produce low-emissions green steel.

The Arrowsmith Hydrogen Project, which will be built at a facility in the town of Dongara, located 320km north of Perth, will utilise dedicated onsite renewable energy 85MW of solar power, supplemented by 75MW of wind generation capacity to generate 25 tonnes of green hydrogen a day and will be operational in 2022.[53]

ATCO’s Clean Energy Innovation Hub, located in Jandakot in Western Australia, is being used to trial the production, storage and use of renewable hydrogen to power a commercial-scale microgrid, testing the use of hydrogen in different settings and applications including in household appliances.[54] This includes optimising hydrogen storage solutions, blending hydrogen with natural gas and using hydrogen a direct use fuel. Green hydrogen will be produced from on-site solar using electrolysis, fuelling a range of gas appliances and blending hydrogen into the natural gas pipeline.

The $3.3 million development project will evaluate the potential for renewable hydrogen to be generated, stored, and used at a larger scale. ATCO aims to assess the practicalities of replacing natural gas with hydrogen at a city-wide scale across a municipality.[55]

The new chair of the Australian Energy Regulator, Clare Savage recently stated:

“The national gas industry could also undergo significant change as some jurisdictions move towards a zero carbon emissions policy. This could have significant consequences for the future of gas pipeline networks. In response, the AER recently supported the future recovery of Jemena’s investment in trialling the production of hydrogen from renewable energy for injection into its Sydney network. If hydrogen trials such as Jemena’s prove successful, the natural gas networks could be re-purposed to distribute hydrogen. If not, the economic life of the assets could be limited.” [56]

Biogas and BiomethaneBiogas is produced by the bacterial degradation of organic waste under anaerobic conditions and is composed principally of methane (50%-75%) and CO2 (25%-50%), with small amounts of oxygen, water and trace amounts of sulphur.[57] After cleaning (desulfurization and drying), biogas can be used to generate electricity and heat in cogeneration units (combined heat power (CHP)) or burnt to produce heat.57 [58] Biogas can also be upgraded (removal of CO2) to biomethane with approximately 98% methane which has similar properties as natural gas.57 58 Both Biogas and Biomethane are flexible renewable fuels that can be stored for later use, with Biomethane is suitable to be added to the natural gas grid.57